Do You Pay Tax On Food In Uk . Some items for human consumption. What qualifies and the vat rate. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. you charge vat on standard rated products at 20%. But food and drink are usually standard rated for vat when provided as part of a catering service. Check the vat rates on different goods and services. You can use zero rates for products sold for use as an ingredient in home cooking or baking: vat on food items. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. For example, hot drinks are always standard rated. Vat on home cooking and baking items. Food and drink for human consumption are often zero rated when supplied by a retailer. do you pay vat on food? if you’re registered for vat, you have to charge vat when you make taxable supplies.

from www.ramseysolutions.com

For example, hot drinks are always standard rated. But food and drink are usually standard rated for vat when provided as part of a catering service. vat on food items. Check the vat rates on different goods and services. Food and drink for human consumption are often zero rated when supplied by a retailer. You can use zero rates for products sold for use as an ingredient in home cooking or baking: if you’re registered for vat, you have to charge vat when you make taxable supplies. Some items for human consumption. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. do you pay vat on food?

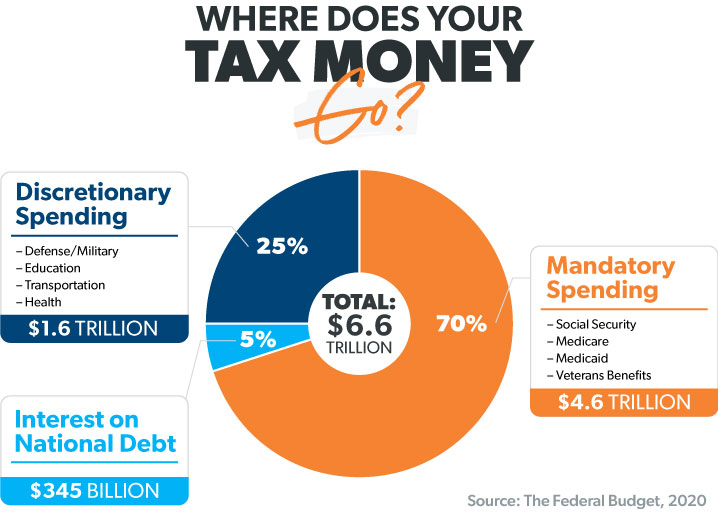

What Do Your Taxes Pay For? Ramsey

Do You Pay Tax On Food In Uk you charge vat on standard rated products at 20%. You can use zero rates for products sold for use as an ingredient in home cooking or baking: What qualifies and the vat rate. For example, hot drinks are always standard rated. Food and drink for human consumption are often zero rated when supplied by a retailer. do you pay vat on food? Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. Vat on home cooking and baking items. you charge vat on standard rated products at 20%. But food and drink are usually standard rated for vat when provided as part of a catering service. Check the vat rates on different goods and services. Some items for human consumption. if you’re registered for vat, you have to charge vat when you make taxable supplies. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. vat on food items.

From cegnymqt.blob.core.windows.net

Do You Have To Pay Taxes On Social Security In South Carolina at Evelyn Do You Pay Tax On Food In Uk Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. Food and drink for human consumption are often zero rated when supplied by a retailer. Vat on home cooking and baking items. Check the vat rates on different goods and services. For example, hot drinks are always. Do You Pay Tax On Food In Uk.

From wisaccountancy.co.uk

UK taxes on foreign Do You Pay Tax On Food In Uk Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. Some items for human consumption. For example, hot drinks are always standard rated. do you pay vat on food? Vat on home cooking and baking items. But food and drink are usually standard rated for vat when provided. Do You Pay Tax On Food In Uk.

From www.nbcnews.com

Here's where your federal tax dollars go NBC News Do You Pay Tax On Food In Uk Check the vat rates on different goods and services. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. do you pay vat on food? For example, hot drinks are always standard rated. if you’re registered for vat, you have to charge vat when you make taxable. Do You Pay Tax On Food In Uk.

From www.bbc.co.uk

tax How will thresholds change and what will I pay? BBC News Do You Pay Tax On Food In Uk you charge vat on standard rated products at 20%. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. Some items for human consumption. Food and drink for human consumption are often zero rated when supplied by a retailer. if you’re registered for vat, you have to. Do You Pay Tax On Food In Uk.

From mavink.com

Payslip Photo Do You Pay Tax On Food In Uk Vat on home cooking and baking items. You can use zero rates for products sold for use as an ingredient in home cooking or baking: do you pay vat on food? For example, hot drinks are always standard rated. vat on food items. you charge vat on standard rated products at 20%. Check the vat rates on. Do You Pay Tax On Food In Uk.

From www.pinterest.com

How to handle food and meals expenses for 2018 Tax Queen Food Do You Pay Tax On Food In Uk Food and drink for human consumption are often zero rated when supplied by a retailer. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. do you pay vat on food? You can use zero rates for products sold for use as an ingredient in home. Do You Pay Tax On Food In Uk.

From www.reed.co.uk

Payslip checker your payslips explained reed.co.uk Do You Pay Tax On Food In Uk if you’re registered for vat, you have to charge vat when you make taxable supplies. Some items for human consumption. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. Food and drink for human consumption are often zero rated when supplied by a retailer. do you. Do You Pay Tax On Food In Uk.

From www.pinterest.com

How to handle food and meals expenses for 2018 Tax Queen Food, Tax Do You Pay Tax On Food In Uk Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. But food and drink are usually standard rated for vat when provided as part of a catering service. do you pay vat on food? You can use zero rates for products sold for use as an ingredient in. Do You Pay Tax On Food In Uk.

From switch.payfit.com

tax — what's it all about? Do You Pay Tax On Food In Uk Some items for human consumption. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. Check the vat rates on different goods and services. Food and drink for human consumption are often zero rated when supplied by a retailer. But food and drink are usually standard rated for vat. Do You Pay Tax On Food In Uk.

From www.tripsavvy.com

UK Customs Regulations Bringing Foods to the UK? Do You Pay Tax On Food In Uk you charge vat on standard rated products at 20%. Some items for human consumption. For example, hot drinks are always standard rated. Food and drink for human consumption are often zero rated when supplied by a retailer. Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby. Do You Pay Tax On Food In Uk.

From www.dreamstime.com

Food taxes stock photo. Image of colours, notes, finance 106751822 Do You Pay Tax On Food In Uk vat on food items. Check the vat rates on different goods and services. What qualifies and the vat rate. For example, hot drinks are always standard rated. if you’re registered for vat, you have to charge vat when you make taxable supplies. But food and drink are usually standard rated for vat when provided as part of a. Do You Pay Tax On Food In Uk.

From www.pinterest.com

Do You Pay More in Taxes Than Housing, Food, and Clothing? Money and Do You Pay Tax On Food In Uk Check the vat rates on different goods and services. You can use zero rates for products sold for use as an ingredient in home cooking or baking: you charge vat on standard rated products at 20%. if you’re registered for vat, you have to charge vat when you make taxable supplies. But food and drink are usually standard. Do You Pay Tax On Food In Uk.

From www.iol.co.za

INFOGRAPHIC 19 food items you will not pay VAT for Do You Pay Tax On Food In Uk you charge vat on standard rated products at 20%. What qualifies and the vat rate. Check the vat rates on different goods and services. Some items for human consumption. Vat on home cooking and baking items. You can use zero rates for products sold for use as an ingredient in home cooking or baking: Standard rate vat is applied. Do You Pay Tax On Food In Uk.

From tacoma-wiring-diagram.blogspot.com

Does The Uk Do Tax Returns / Filling In The Inland Revenue Self Do You Pay Tax On Food In Uk Vat on home cooking and baking items. Check the vat rates on different goods and services. What qualifies and the vat rate. if you’re registered for vat, you have to charge vat when you make taxable supplies. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. . Do You Pay Tax On Food In Uk.

From www.simplepersonalloans.co.uk

Understanding Your Payslip Simple Personal Loans Do You Pay Tax On Food In Uk Vat on home cooking and baking items. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. Food and drink for human consumption are often zero rated when supplied by a retailer. For example, hot drinks are always standard rated. You can use zero rates for products sold for. Do You Pay Tax On Food In Uk.

From rebrn.com

Order number on this receipt is the same as the cost of the food Do You Pay Tax On Food In Uk Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. You can use zero rates for products sold for use as an ingredient in home cooking or baking: vat on food items. Whether you supply these unprocessed foodstuffs direct to the public or for use as. Do You Pay Tax On Food In Uk.

From www.ramseysolutions.com

Where Does Your Tax Money Go? Do You Pay Tax On Food In Uk Standard rate vat is applied on all food items consumed on the premises of a pub or restaurant, which includes designated nearby areas. you charge vat on standard rated products at 20%. But food and drink are usually standard rated for vat when provided as part of a catering service. vat on food items. do you pay. Do You Pay Tax On Food In Uk.

From ebizfiling.com

A complete guide on GST rate on food items Do You Pay Tax On Food In Uk Food and drink for human consumption are often zero rated when supplied by a retailer. do you pay vat on food? Vat on home cooking and baking items. Whether you supply these unprocessed foodstuffs direct to the public or for use as ingredients in the manufacture of processed foods. you charge vat on standard rated products at 20%.. Do You Pay Tax On Food In Uk.